Why Invest

We are a steadily growing group of companies operating in the vital sectors of agriculture and food production.

Centered on profitable and sustainable growth, we continually advance all core activities, and leverage synergies across diverse areas of operation.

Discover more

Company Overview

AB Akola Group

Registered on November 27th, 1995

Auditor: UAB ERNST & YOUNG BALTIC

Date of listing: February 17, 2010

Address: Subačiaus St. 5, Vilnius LT-01302, Lithuania

Telephone +370 663 83888

Email [email protected]

AB Akola Group is the agribusiness and food group holder. The primary role of the company is managerial, and it does not directly engage in trading or production activities. Instead, its subsidiaries, under its control, are involved in a diverse range of operations. These include the supply of agricultural inputs, farming, processing of farm products, poultry production, flour milling, instant foods production, compound feed manufacturing, pet food production, agricultural commodities trading, and veterinary pharmacy supplies.

The financial year for the companies within the group commences on the 1st of July.

Akola Group Strategy

Akola Group’s strategy is centered on profitable and sustainable growth, continually advancing all core activities, and leveraging synergies across diverse areas of operation.

Analyst Coverage

In periodic reviews, independent financial experts provide insights into the performance of the Akola group.

Recommendations

Bear:

EUR 1.64

Base:

EUR 2.10

Bull:

EUR 2.56

Last Update: 27 /02 / 2026

Target Price:

EUR 2.00

Previous Price:

EUR 2.00

Recommendation:

Buy

(reiterated)

Last Update: 24 / 02 / 2026

Reports for retail investors

Akola Group (hereafter referred to as “The Company”) is followed by the analyst(s) listed below. Please note that any opinions, estimates or forecasts regarding The Company’s performance made by these analysts are theirs alone and do not represent opinions, forecasts or predictions of The Company or its management. The Company does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations. The Company has no control over the content, quality, nature or reliability of any such third party report(s), and shall have no liability whatsoever in respect to the information provided in them.

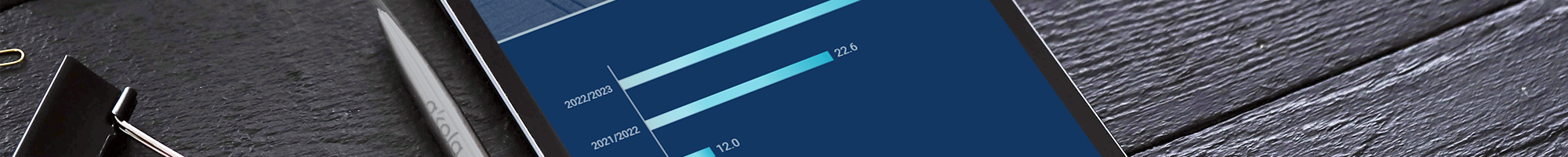

Dividends

AB Akola Group follows the dividend policy approved by the Group’s Management Board on 15 June 2023, which aims to increase the value of the company and ensure a long-term return on investments.

| Fiscal Year * | Dividends for the period, EUR | Dividends for the period paid per share, EUR before taxes |

| 2024/2025 | 14,991,644 | 0.09 |

| 2023/2024 | 4,995,255** | 0.03 |

| 2022 / 2023 | 4,169,125** | 0.026 |

| 2021 / 2022 | 5,000,000 ** | 0.0313 |

| 2020 / 2021 | 0 | 0 |

| 2019 / 2020 | 0 | 0 |

| 2018 / 2019 | 0 | 0 |

| 2017 / 2018 | 2,926,097 ** | 0.0185 |

| 2016 / 2017 | 1,202,004 ** | 0.0076 |

| 2015 / 2016 | 1,201,966 ** | 0.0076 |

| 2014 / 2015 | 1,201,966 ** | 0.0076 |

| 2013 / 2014 | 1,447,400.66 | 0.00915 |

| 2012 / 2013 | 1,737,720 | 0.0109 |

| 2011 / 2012 | 1,303,290.08 | 0.0082 |

| 2010 / 2011 | 0 | 0 |

* Financial year starts on July 1st and ends June 30

** Calculated excluding own shares acquired by the Company.

Contact for Investors

Mažvydas Šileika

Member